Robins News

March 4, 2025 Special election

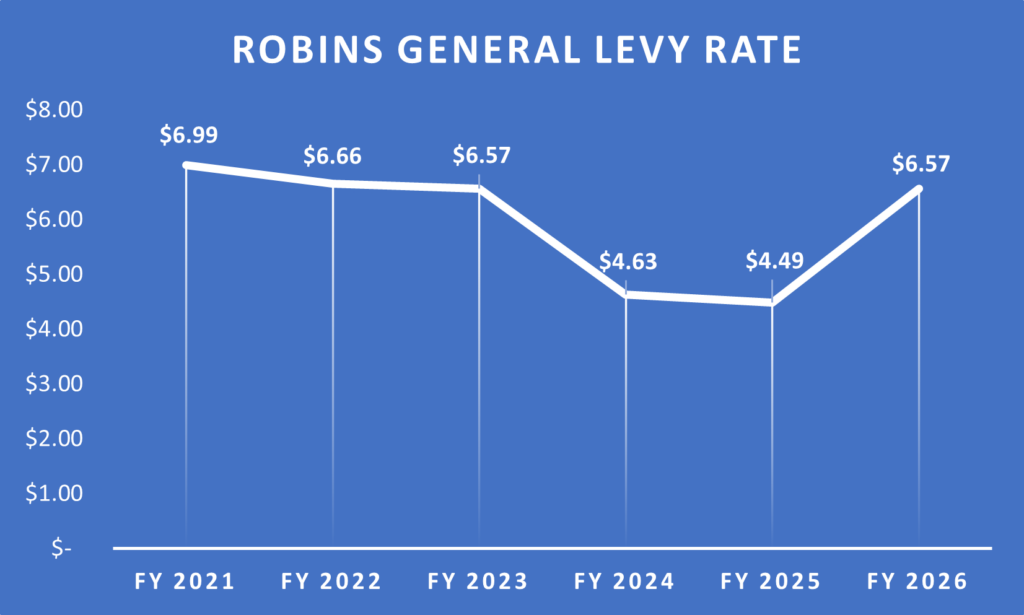

The City of Robins is asking you to vote on Tuesday, March 4th to return the City’s property tax levy rate to the 2023 level of $6.57.

Robins residents have enjoyed the City’s low property tax rates – the lowest in the Metro area — for decades. During the Fiscal Year 2024 (July 2023 – June 2024) budgeting process, the City mistakenly lowered its property tax levy to an unsustainable level, which left several departments underfunded. Legislation at the state level, passed in May 2023 and known as House File 718, effectively prevents Robins from raising its General Fund Levy without approval by voters.

For the past two years the City has been able to cover expenses but has not been able to contribute to its reserve fund (savings) as in years past. Growth in staffing and services for these departments (Police, Fire, Parks, Administration, Building) is not possible at current funding levels. Looking to the future, without additional funding, the City may have to reduce or eliminate services in these departments.

By restoring the City General Fund Levy rate to the FY 2023 level of $6.57 per thousand, an additional $553,602 will be added to the City’s General Fund in FY 2026. Service and staff reductions will be avoided and contributions to reserve funds will resume.

The March 4, 2025 Special Election will be held at Community Savings Bank. Polls will be open from 7 a.m. to 8 p.m. Visit LinnCountyIowa.gov/vote for more election-related material such as:

- Absentee Ballot Request Forms

- Voter Registration Forms

- Sample Ballots (Available by February 01.)

- Polling Locations

- Election Day Information

Join us on February 11, 2025 at Communiy Savings Bank in Robins for an Open House to learn more about this important issue.

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 | Proposed FY 2026 | |

| General Fund Levy Rate | $6.99 | $6.66 | $6.57 | $4.63 | $4.49 | $6.57 |

Proposed increase per $100,000 valuation: $103.55

how revenue restrictions affect our city

police department

The Robins Police Department faces staffing challenges, as we look to add a second full-time officer to meet the growing demands of our expanding city. Without a return to the 2023 General Levy rate of $6.57, budget restrictions may prevent us from offering the competitive compensation necessary to attract top-tier candidates. Consequently, our department faces a staffing shortage in the coming Fiscal Year.

Fire Department

Without a return to the 2023 General Levy rate of $6.57, the Robins Fire Department will no longer have the funds necessary to contribute to reserve funds (savings) for the purchase of major equipment such as fire engines, which often exceed $1 million. We will have no choice but to sell bonds for these large purchases and pass the cost on to our taxpayers. Our residents depend on our first responders’ ability to respond to emergencies quickly and with a high level of skill and training. If budgetary cuts become necessary, this vital service could be affected.

parks

With the completion of the new 16-acre Robins Landing Park, sustainable funding to develop, maintain, and enhance our park amenities is critical. Without a return to the 2023 General Levy rate of $6.57, the city will lack the necessary resources to continue the development of our parks and trails and meet the increasing demand for recreational spaces. Without additional funding, our newest park will have no amenities to offer to Robins’ citizens.

administration

As our city continues to grow, it is clear that our General Fund revenue is not keeping pace with increasing demands for services and infrastructure. Approval of this levy is a necessary course correction to stabilize our budget and allow us to continue to provide the services and amenities that make Robins a great place to live.